PR Agency Search Report 2019

The Impact of the Agency Selection Process on Public Relations Programs and Outcomes

Click here to download the research report.

Contents

Acknowledgements

Introduction

Methodology

Executive Summary

Research Highlights/Key Findings

Multiple Agencies, Healthy Budgets the Norm

Communications Leaders Rely on Experience and Knowledge to Identify Limited Number of Agency Candidates

Satisfaction with Agencies Generally Robust, But...

Clients Less Satisfied with Agencies with Highest Budgets

Agency Longevity Correlated with Satisfaction

Communications/Marketing Background vs. Satisfaction

Comprehensive RFP Process Results in Better Outcomes

Conclusions

Acknowledgements

The research presented in this report could not have been completed without the encouragement and support of a number of individuals and organizations. Chief among them were Researchscape International, Tina McCorkindale, Ph.D., APR, President and CEO of the Institute for Public Relations, and Jennifer Swint, Global President and Chief Client Officer of Porter Novelli.

As our partner on this project, and on crisis communications and opinion survey services offered through CommunicationsMatch, we would like to express our appreciation to the Researchscape team. Jeffrey Henning, Founder & CEO, Tony Cheevers, Head of Business Development and Lili O’Reilly’s communications research expertise was invaluable in the development of the research and evaluation of its results. Researchscape’s survey technology is a powerful platform that made the process of executing the survey, cross-tabulating the findings and production of initial AIgenerated results reports and charts highly efficient.

The Institute for Public Relations (IPR), dedicated to the science beneath the art of public relations played a key role in this study. Two years ago, the Institute launched its Bridge Conference to encourage research and exchange between the worlds of professional practice and academic inquiry. Consistent with IPR’s mission, we developed and implemented this research – specifically for presentation at the 2019 Bridge Conference – to provide insights into the process organizations use to hire public relations agencies. The questions in the quantitative survey were reviewed and edited by Dr. McCorkindale and Ms. Swint, whose guidance and perspective were invaluable.

We are also immensely grateful to the following individuals who supported this project through their counsel, outreach, and promotion. • Susan Matthews Apgood, News Generation • Jordan Appel, Research Associate, CommunicationsMatch • Karla K. Gower, Ph.D., Director, The Plank Center for Leadership in Public Relations, University of Alabama • Paul Holmes, Founder, The Holmes Report • Sarah Jackson, Director of Communications, Institute for Public Relations • Mitch Marovitz, Ph.D., APR, Fellow PRSA, Chair PR Program and Collegiate Professor, University of Maryland/Global Campus 4 • Judy Phair, APR, Fellow PRSA, President, PhairAdvantage Communications, LLC • Danny Selnick, Business Consultant • Sergei Samoilenko, Communications Faculty, George Mason University • Fay Shapiro, Group Publisher, CommPro.biz • Susan Whyte Simon, APR, Fellow PRSA, University of Maryland Department of Communication • John O’Dwyer, Publisher, O’Dwyer’s PR • Kathleen Quilligan Sebastian, President, PRSA National Corporate Section • Cylor Spaulding, Ph.D., Faculty Director and Assistant Professor of the Practice, Public Relations and Corporate Communications Program, Georgetown University School of Continuing Studies • Kirk Stewart, Founder and CEO of KTStewart and Board Member of University of Southern California’s School of Journalism • Alexa Tahan, Program Director, Marketing and Communications Master’s Programs, Georgetown University School of Continuing Studies

Simon Erskine Locke, CommunicationsMatch™

Steve Drake, RFP Associates, LLC

Robert Udowitz, RFP Associates, LLC

Introduction

When a corporation or a major industry association/non-profit seeks to hire a senior communications executive with an annual compensation package of $150,000 or more, the organization’s human resources department springs into action. It may retain the services of an executive search firm to provide support and identify qualified candidates. It solicits and receives dozens of resumes. Interviews are scheduled, backgrounds are checked, finalists are selected, and interviews, with multiple members of senior management, are planned.

It’s a process, as it should be. And it’s comprehensive. After all, the organization wants to make sure it is offering the job to the very best candidate.

When that same organization seeks to retain the services of a public relations agency – one with which the organization might spend $250,000, $500,000, perhaps $1 million or more per year – how, precisely, does it ensure that it’s retaining the very best agency partner? Does it undertake a process similar to that used when it hires full-time employees, such as that senior communications executive?

In the spring of 2019 CommunicationsMatch and RFP Associates partnered with Researchscape International to conduct a survey of chief communications officers and senior executives at Fortune 1000 corporations and large non-profit organizations, regarding their communications agency search and hiring practices.

Although companies worldwide spent an estimated $15 billion in 2018 on public relations agency services, according to industry publication The Holmes Report, and while public relations trade publications for many years have conducted surveys and produced lists that rate and rank agencies, limited attention has been paid to the agency hiring process.

Our goals for this research – which we believe is the first national survey of its kind – was to better understand how client organizations conduct agency searches, and to evaluate the relationship between the thoroughness of the agency hiring process and satisfaction with agencies and program outcomes. The results offer valuable insights and lessons for client organizations looking to retain agencies, as well as for agencies themselves competing for the attention, and ultimately the hiring decision, of potential clients. We welcome perspective, feedback and questions.

Methodology

A 30-question online survey was developed by the authors of the study, with support from Tina McCorkindale at the Institute for Public Relations and Jennifer Swint at Porter Novelli (see acknowledgments).

The online survey was distributed through web links to a targeted list of chief communications officers or their equivalents at 800 publicly traded corporations, large private companies, and non-profit trade associations.

The survey was also promoted through online public relations media including The Holmes Report and CommPro.biz. The survey was conducted using Researchscape’s survey and results reporting technology.

The survey was launched on February 25, 2019 and was live for six weeks. No financial incentives were provided to respondents, but those who participated were promised an advance copy of the findings. There were 89 respondents, which Researchscape indicated constituted a response rate that is typical and reliable for a similar survey of C-level executives at large, well-known brands.

Preliminary findings were shared at the Institute for Public Relations 2019 Bridge Conference on April 11, 2019, in Washington, D.C.

Additional follow up interviews/discussions were conducted after the close of the survey with five communications executives who had responded to the survey and invited the authors to contact them for additional discussion.

The five represented industries including automotive, energy, transportation, medicine, and management and information consulting. We asked additional questions about their search process, how candidate agencies were identified, how agency proposals were reviewed, the amount of time invested in agency selection, and more. The perspective provided by these respondents was consistent with and a valuable supplement to the survey responses. The information gathered during the qualitative component of the research is woven into the Research Highlights/Key Findings section, within this report.

Executive Summary

A key objective of this research was to determine the impact of the agency search process on PR or communications program outcomes reflected in satisfaction with hired agencies. We specifically wanted to provide communications and agency leaders research-based data to inform best practices for agency search.

The data reveals links between a thorough search process, client satisfaction and agency longevity.

Although the majority of communications leaders at the large companies and organizations we surveyed rely on their experience and networks to find only two to five agency candidates in their searches, the importance of a comprehensive search process is not lost on them. Many acknowledged that identifying more candidates early on, and dedicating more time to the process overall, would be ideal.

Across the findings, a clear picture emerges of the value of a thorough search and hiring process to achieving desired outcomes and strong, long-lasting agency relationships.

While client organizations are using RFPs, partnering with other departments, identifying what we would consider a minimum number of candidates in the search process, and are generally satisfied with the way in which searches are conducted, at a minimum, the research points to opportunities to improve processes and outcomes. It also highlights the significant gap between the approach taken when hiring employees and agencies, where the annual budget is often a multiple of that for an individual hire.

Following are key data points from the research – all of which are explained and analyzed in detail in the balance of this report:

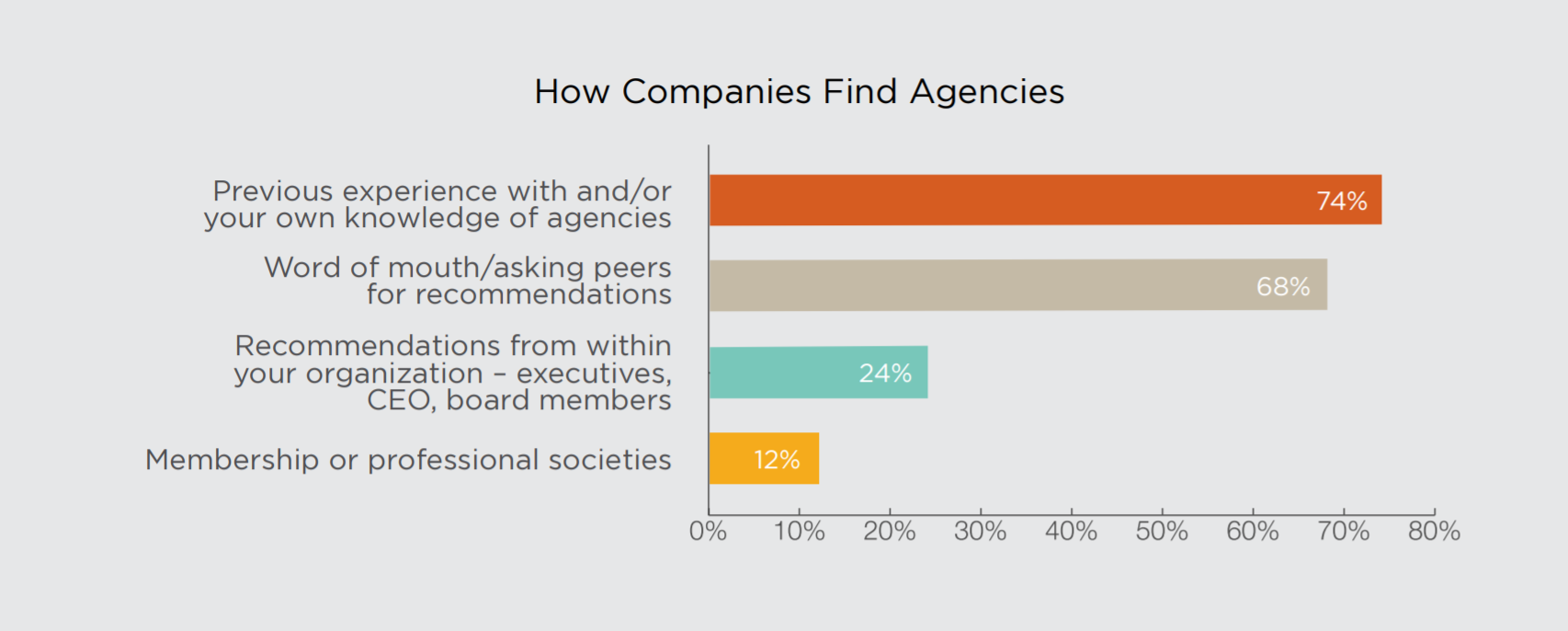

- Around three-quarters of communications executives said they rely on their own knowledge, and two-thirds on the advice of peers when selecting initial agency candidates at the outset of a search:

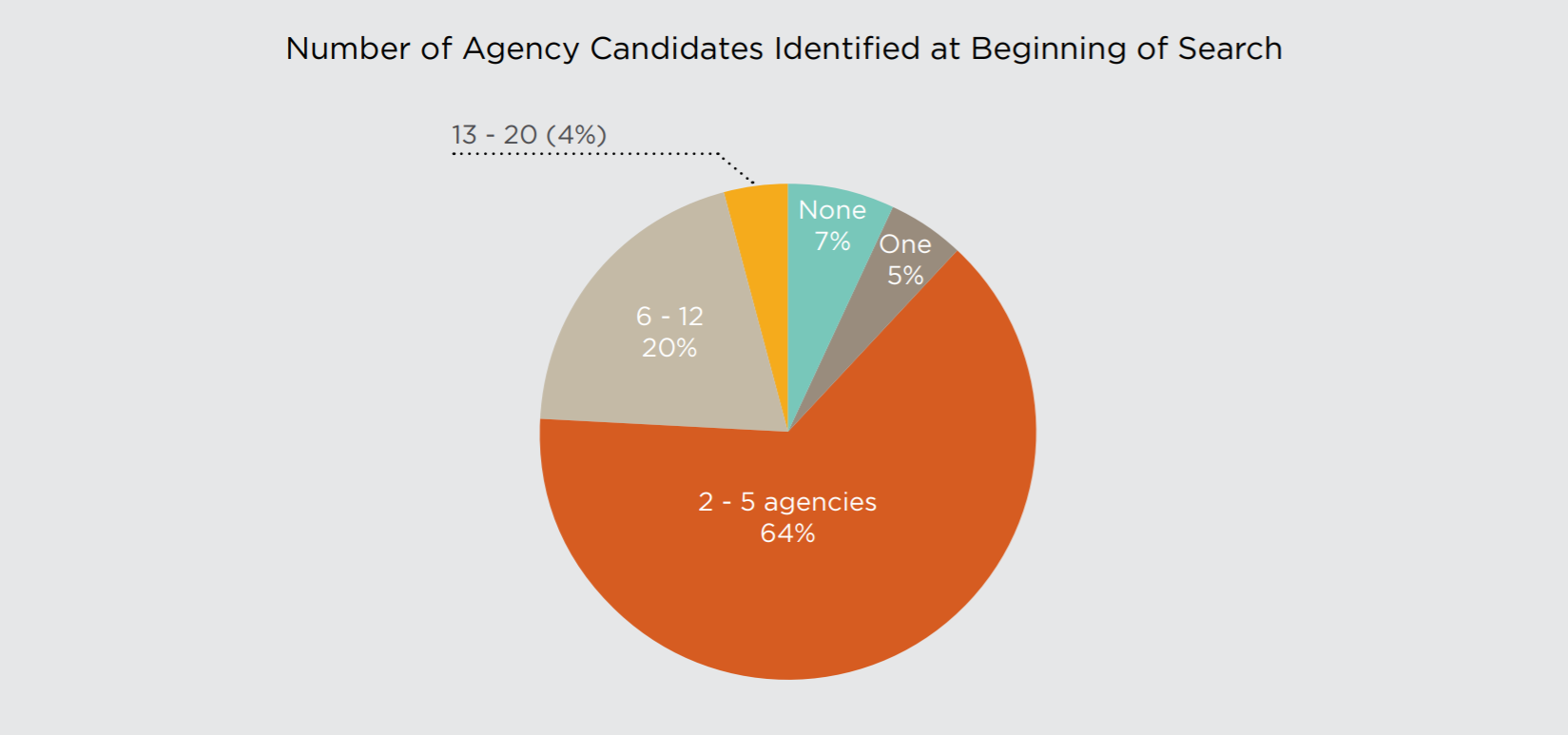

- 64% of clients identified two to five agency candidates during the selection process.

- 67% relied on word of mouth or asking peers for agency recommendations.

- Less than 15%, individually, referred to the trade media, online search engines, agency search platforms, professional societies, or agency search consultants as resources for finding an agency.

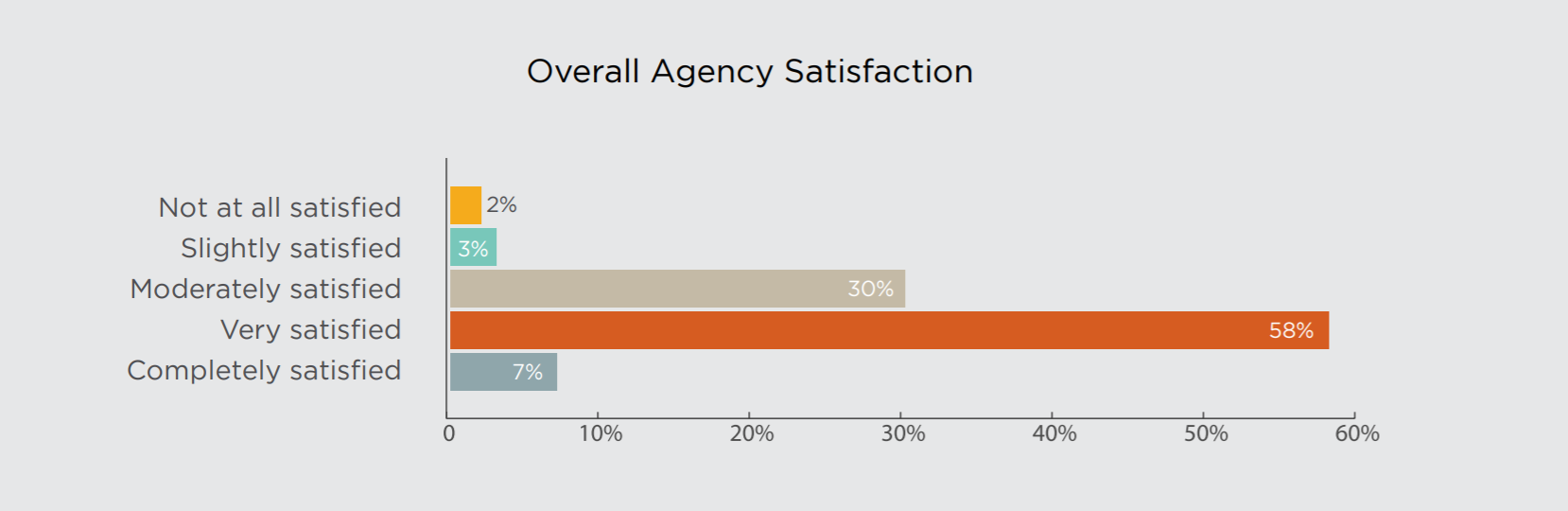

- Client satisfaction with agencies is robust overall, but there are issues

- 65% indicated they were “very” or “completely” satisfied with their primary agency.

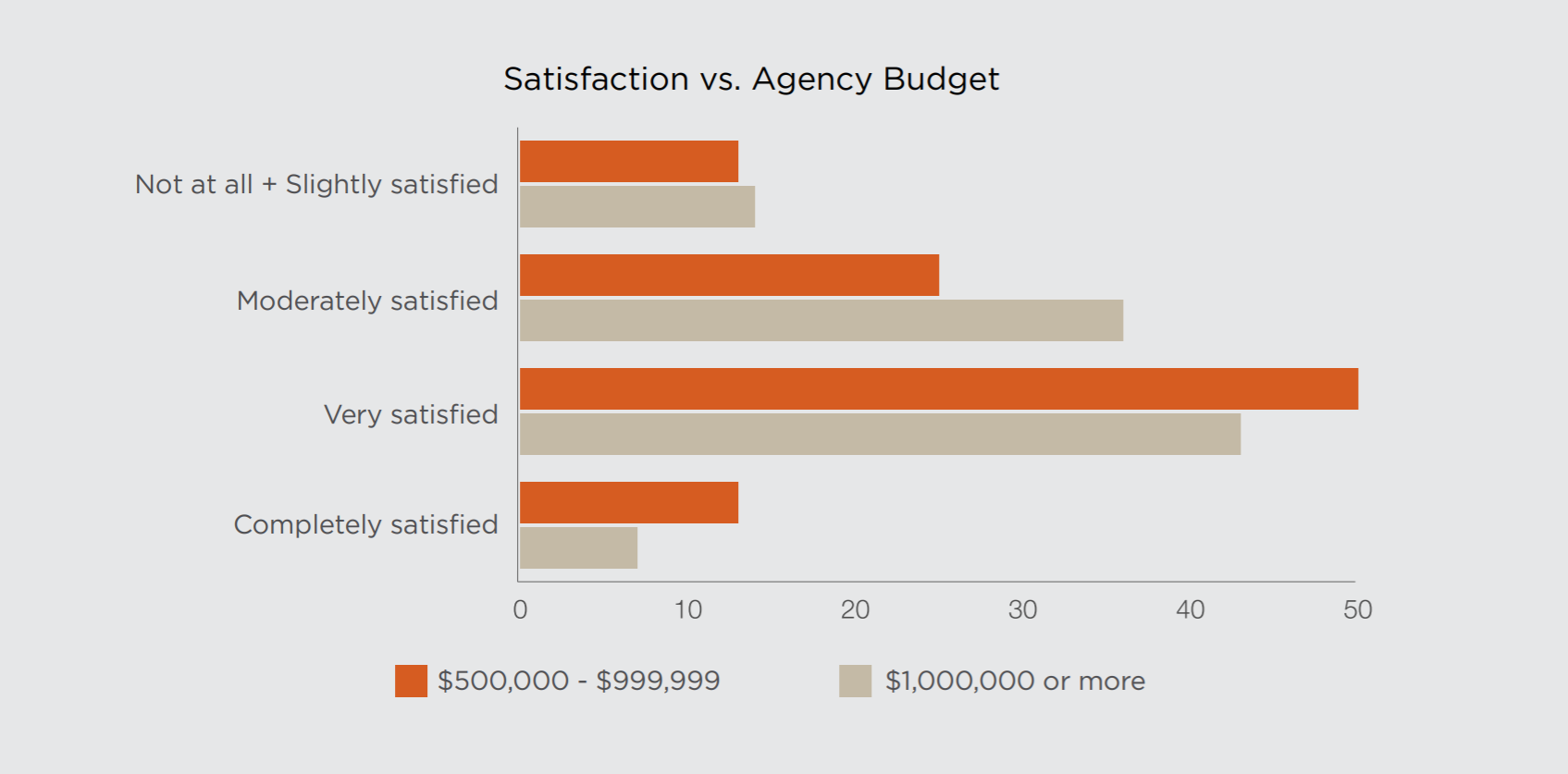

- Respondents were less satisfied with particular components of the agency working relationship, including proactivity, account coordination, quality, staff turnover, meeting objectives, and meeting budget expectations and deadlines. • Clients were also less satisfied with agencies with higher budgets, with 50% “moderately,” “slightly,” or “not at all” satisfied with agencies paid more than $1 million annually.

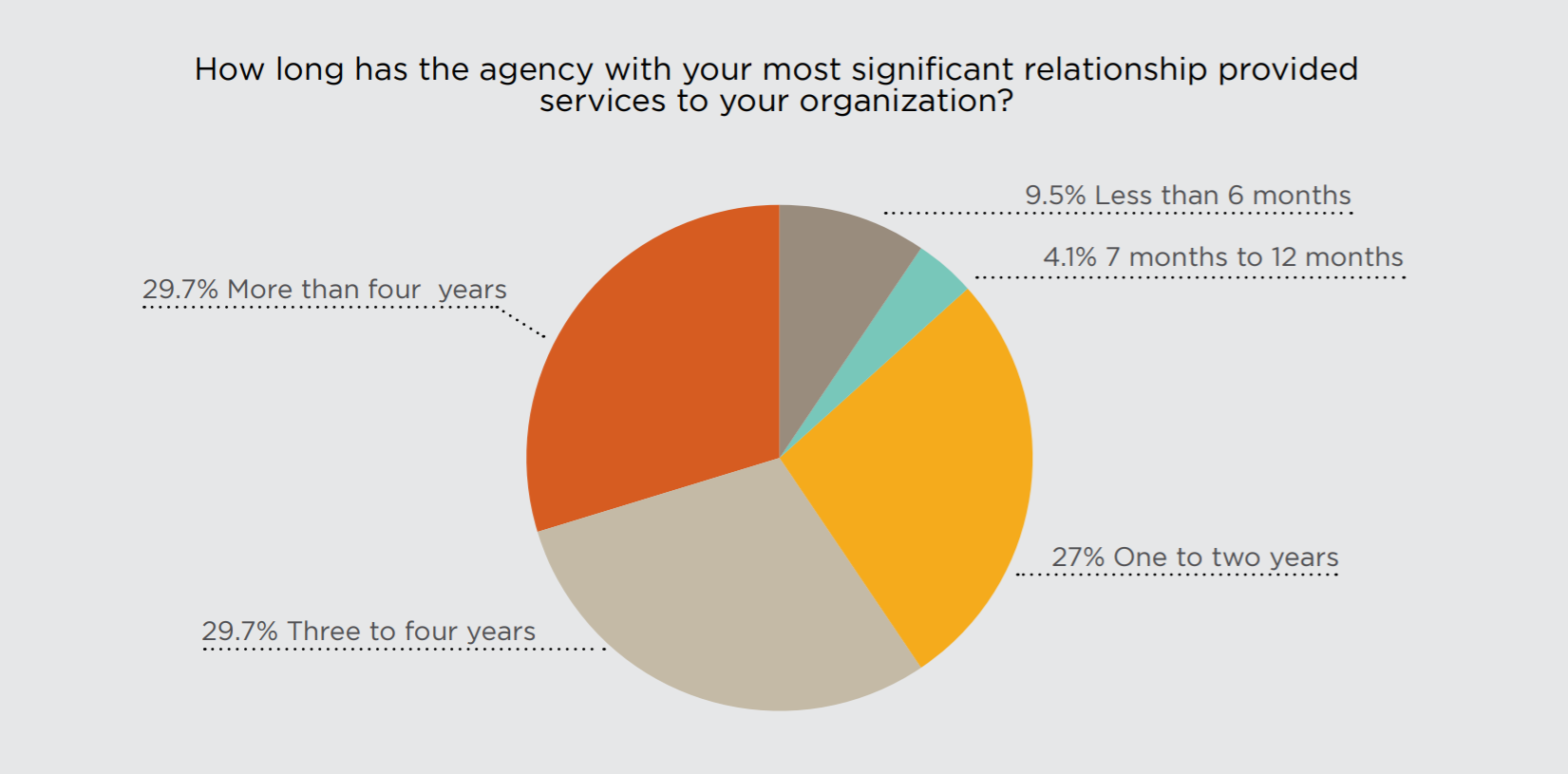

- Agency turnover is an issue, while longevity is tied to client satisfaction

- Communications executives reported that among their most significant agency relationships, 30% were more than four years; 30% were three to four years; 27% were one to two years; and 14% were for less than a year.

- When satisfaction is high, relationships are longer.

- Three-quarters of clients report being satisfied with their agency search process overall, but are less satisfied with specific components of the process:

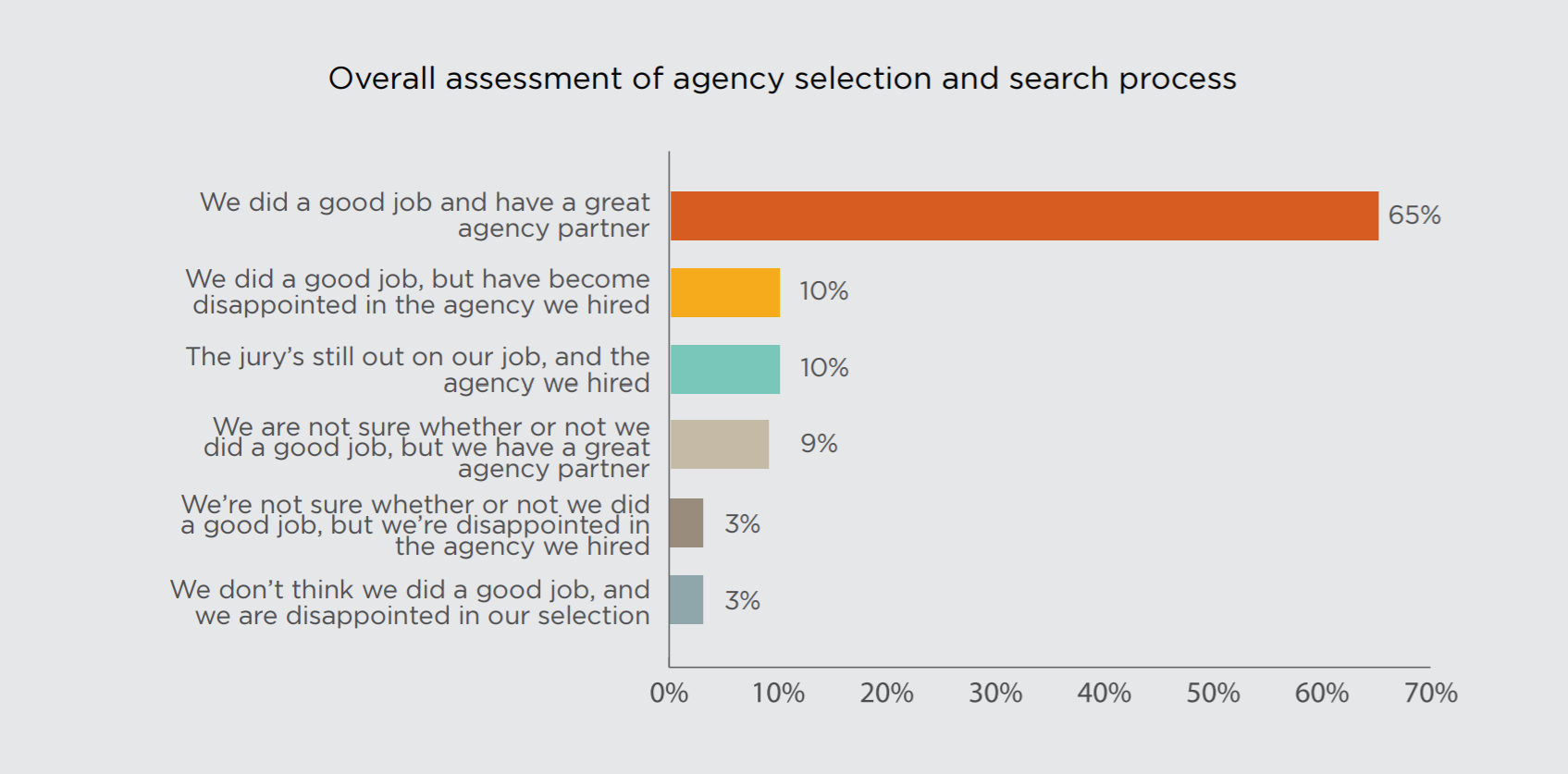

- About 65% indicated “We did a good job and have a great agency partner.”

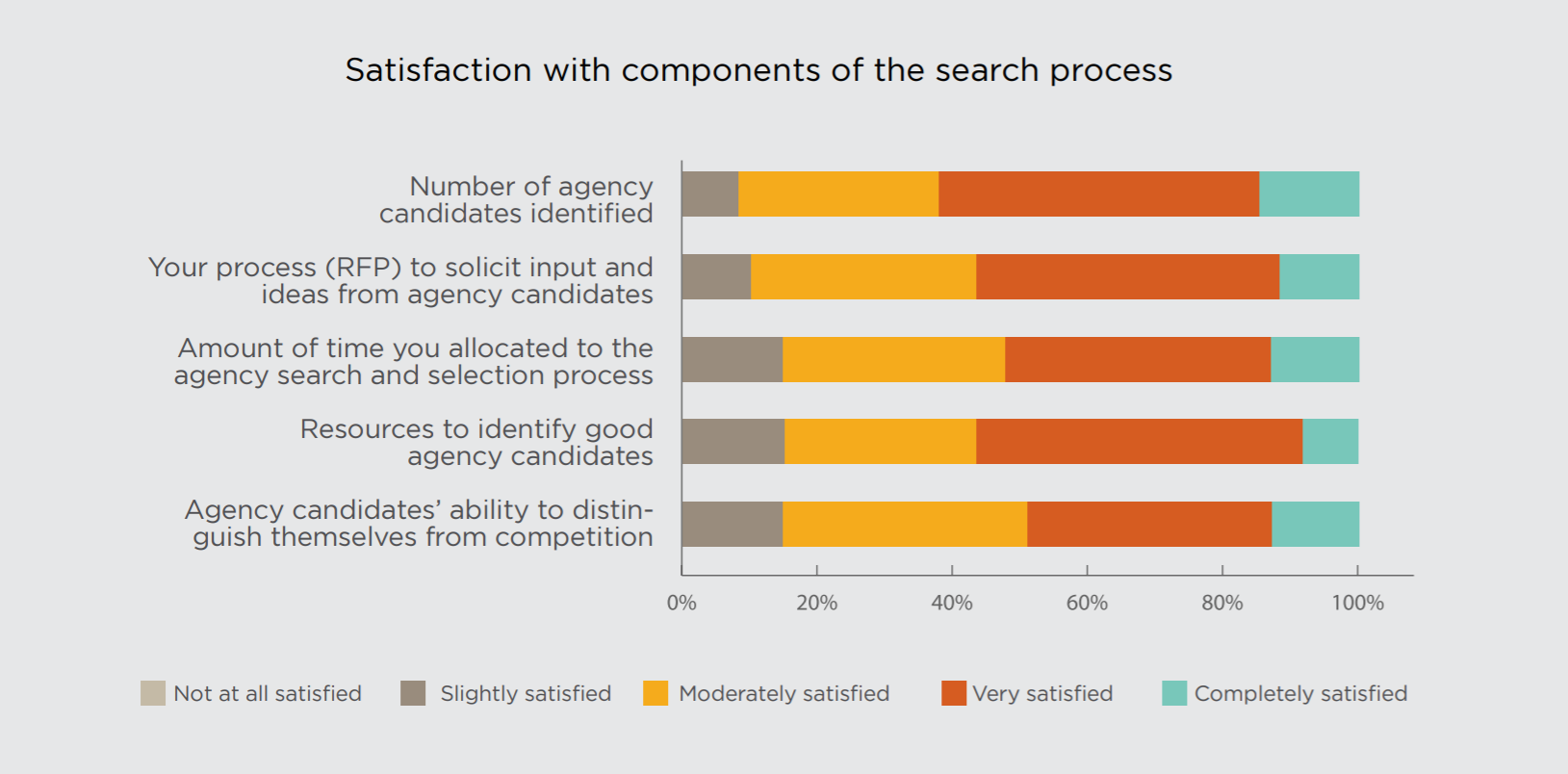

- Consistently, a significant number of respondents (around 40% or more) said they were only “moderately” or “slightly” satisfied with time spent conducting the search, their RFP process, and agency candidates’ ability to distinguish themselves from their competition.

- Communications executives with public relations agency experience were less satisfied overall with their agency search process, including the number of candidate agencies examined, the method used to shortlist candidates, and the qualifications of the shortlisted agency candidates.

- A better and more comprehensive search process leads to better outcomes.

- The research highlighted the benefits of a thorough agency search process including higher agency satisfaction – a proxy for PR/communications program performance – better results, and longevity.

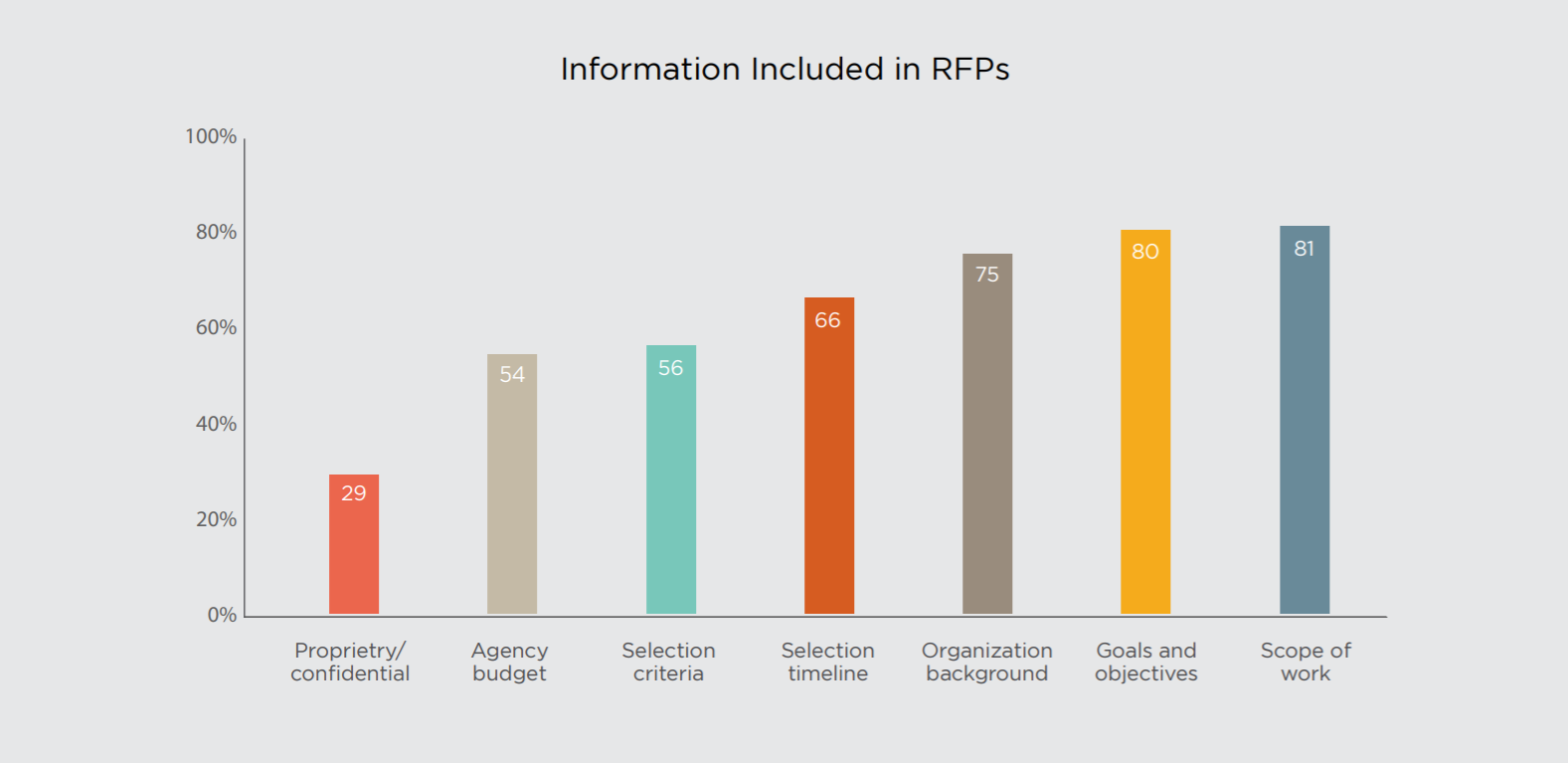

- Two-thirds of respondents (64%) used RFPs in their search process.

- Nearly all (about 80%) of respondents said they include “Goals and Objectives” and “Scope of Work” in their RFPs.

- However, budgets were shared in only about half of the RFPs (54%), slightly more than half shared selection criteria, and less than 30% provided proprietary or confidential information – which could be considered useful, even essential, to well-considered responses.

Research Highlights/Findings

The results provide insights into the agency hiring process and offer valuable takeaways for clients (the corporations and non-profit organizations which responded to the survey) as well as the agencies that compete for their business.

Multiple Agencies, Healthy Budgets the Norm

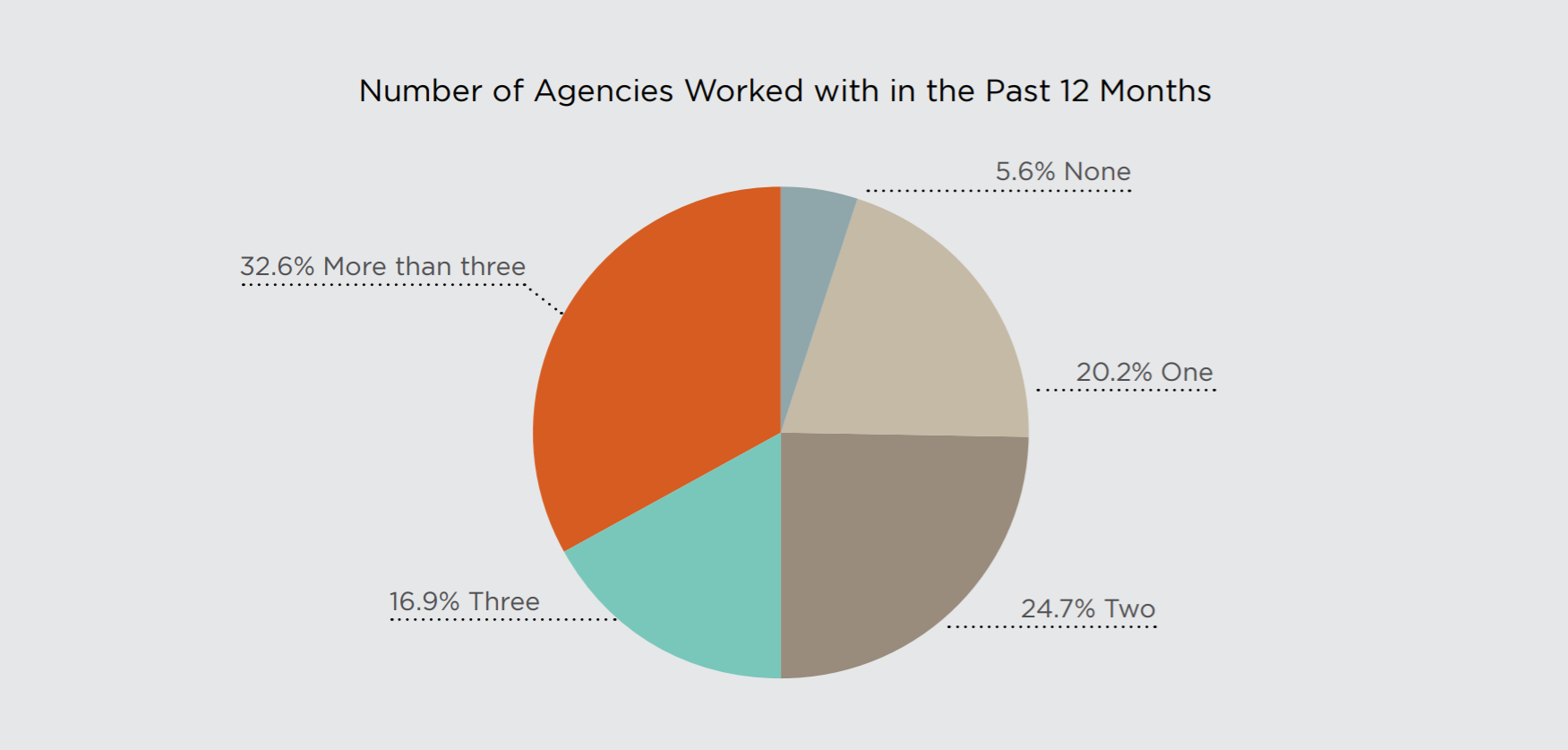

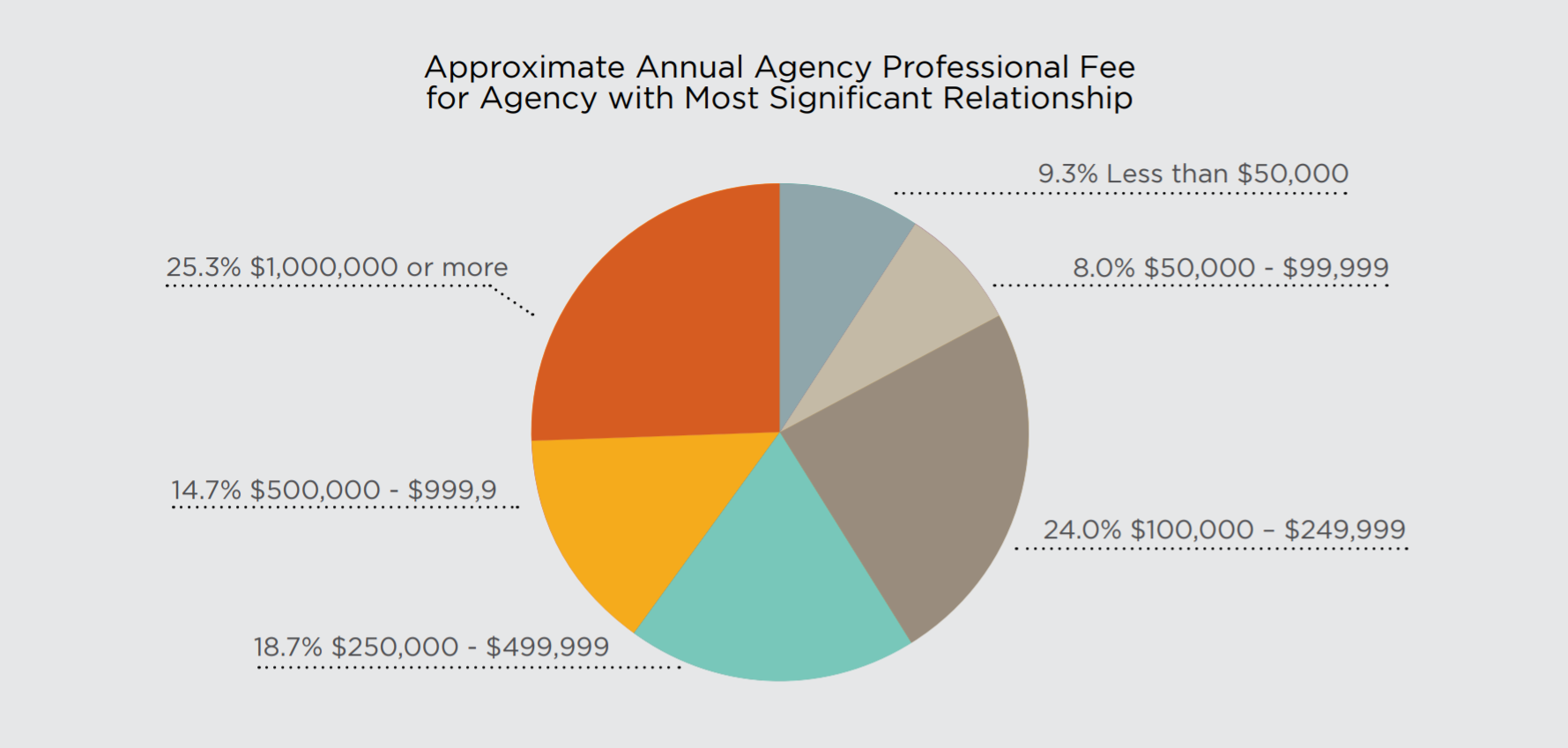

Half of the respondents said they rely on three or more agencies to support their communications efforts. A quarter of respondents indicated they are investing more than $1 million with the agency where they have the most significant relationship.

Most respondents indicated they were investing substantial resources with their public relations firms, with 15% spending between $500,000 and $1 million annually, almost 20% between $250,000 and $500,000, and nearly 25% between $100,000 and $250,000 per year.

Qualitative Interviews

Respondents indicated a strong reliance on their primary agencies, which were paid more than $1 million. At the same time, they suggested they were “harder” on their primary agencies:

Analysis

- Agency new business opportunities are strong. The research indicated that most large organizations – corporations or non-profits – retain more than one agency, with many hiring three or more. And agency budgets are healthy, with a quarter of respondents saying they spend more than $1 million with their primary agency.

- While the industry has speculated on the decline of the agency of record (AOR), the research shows the continued importance of “primary” agencies of the size and scale required to deliver many traditional PR services in the U.S. and abroad (25% of respondents said they use a single agency for global reach). It also highlights the key role of specialty firms based on industry/sector expertise or regional knowledge to fulfill specific needs.

Communications Leaders Rely on Experience and Knowledge to Identify Limited Number of Agency Candidates

More than seven out of ten senior corporate or marketing communications leaders said they rely on their experience and industry knowledge, and nearly two-thirds on “word of mouth,” to find agency candidates at the beginning of a search. The research showed the reliance on experience and word-of-mouth far outweighs the use of other potential resources to identify agencies, including drawing upon industry association resources or using agency search professionals.

But they tend to identify a limited number of agency candidates. Two-thirds (64%) of senior communications executives said they begin public relations agency searches with between just two and five initial candidate agencies.

Qualitative Interviews

Respondents suggested that specialized, boutique firms are highly valued and shared their perspective on how they identify agencies:

Analysis

- Agency search tools are available to help companies broaden the pool of qualified agencies. CommunicationsMatch enables client organizations to generate shortlists from more than 5,000 agencies and professionals by industry and communications expertise, location and size, as well as designations and diversity, quickly and efficiently. Trade and association directories also offer search options. The bottom line - clients need only carve out a small amount of time to identify a broader selection of qualified candidates to meet minimum standards of due diligence or procurement requirements.

- In the selection process for agencies it’s clear that communications leaders rely on their own experience or that of their network to identify a limited number of agencies they believe are qualified for their needs.

- Drawing upon experience and peer recommendations to select a very limited number of candidate agencies is clearly not a coincidence, but by reducing the pool of candidate agencies, communications leaders are likely missing out on the benefits of a more encompassing and rigorous search process.

- In fact (as detailed in the next section), survey respondents note the process would be better if they included more agencies and give the process more time. Since most expressed overall satisfaction with their search process, it seems as though a “good enough” path to hiring agencies is the norm.

Satisfaction with Agencies Generally Robust, But. . .

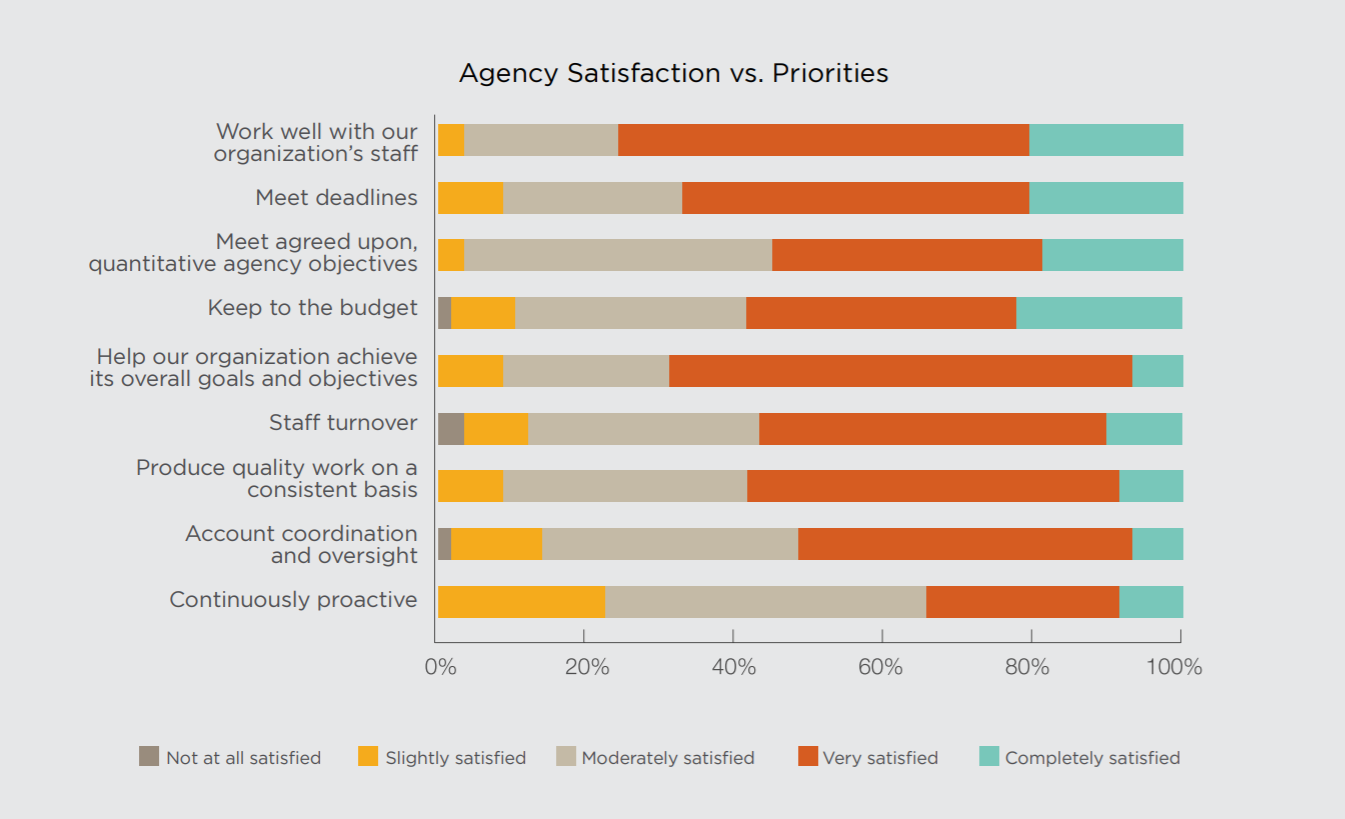

The survey shows a high level of overall satisfaction with agencies, but that is not the end of the story. When we asked about satisfaction with specific aspects of agency relationships important to client companies, we consistently saw around 40% of respondents only moderately or slightly satisfied with agencies’ performance.

Satisfaction with agency proactivity, account coordination, quality, staff turnover, meeting objectives, meeting budget and deadlines were all issues of concern for communications executives. Seven in ten respondents were moderately or less satisfied with agency proactivity and 44% with agency’s meeting objectives.

Satisfaction with agency proactivity, account coordination, quality, staff turnover, meeting objectives, meeting budget and deadlines were all issues of concern for communications executives. Seven in ten respondents were moderately or less satisfied with agency proactivity and 44% with agency’s meeting objectives.

Clients Less Satisfied with Agencies with Highest Budgets

A notable finding from the research is that satisfaction with larger agencies with budgets in excess of $1 million tended to be lower overall than with agencies where the budget was between $500,000 and $1 million.

Where agency budgets are less than $500,000, the research shows the highest level of satisfaction in the $250,000 to $500,000 range.

Analysis

- While agencies overall enjoy high marks from clients – nearly two-thirds of respondents said they were “completely” or “very” satisfied with their primary agency – communications executives’ views were clearly not as sanguine regarding more specific measures of agency performance and responsiveness. Some of the lowest satisfaction ratings were offered by clients of agencies that were spending $1 million or more annually.

- The middling agency satisfaction scores for performance and responsiveness cannot all be traced back to the selection of a particular agency by a client, as a lot goes into a client-agency relationship after a hiring decision has been made. But they should offer lessons and merit further consideration to both communications executives and agencies seeking (or winning) their business.

Agency Longevity Correlated with Satisfaction

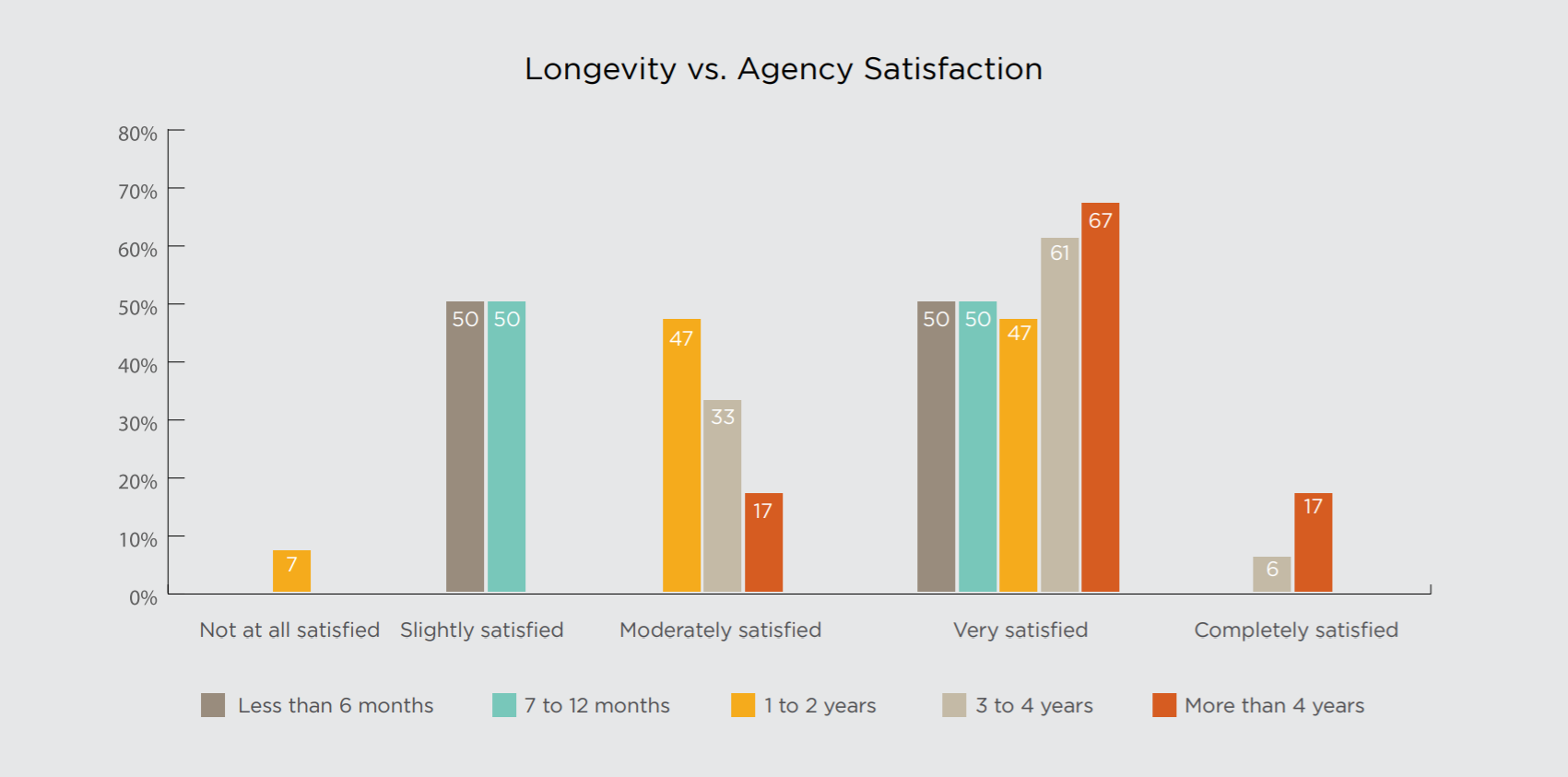

The data show a correlation between agency satisfaction and the length of relationships. Perhaps not surprisingly, where agency relationships were four years or longer, clients tended to be highly satisfied. It should give pause that only 30% of primary agency relationships were reported to be four years or longer in length. The 70% of relationships reported to be three years old or less underscore both the high level of agency turnover in the industry and demand for agencies with new skillsets.

Satisfaction is clearly tied to delivering promised results, effective engagement with clients, and managing against budgets. As the following chart illustrates, satisfaction is correlated with longevity. The highest number of clients who reported being very satisfied were those where relationships were four years or longer. Far lower numbers of those with longer relationships were only moderately satisfied with agencies. Lower levels of satisfaction (not satisfied or slight satisfaction) were more often associated with shorter term relationships. The chart reveals half of those hired within a year were slightly satisfied and the other half very satisfied. This underscores the idea – reinforced by other data in the study - that the hiring process as currently practiced is a bit of a lottery.

Analysis

- When an agency may get off to a rocky start, the research indicates there’s a commitment to improving relationships. There’s another potential way to look at this. When shortcuts are taken in the hiring proces, client and agency expectations may not be aligned, requiring work by both parties once the relationship has been established to get on the same page.

- It should not be a surprise that satisfaction is correlated with agency longevity. Clients satisfied with their agency relationships are likely to continue working with them. Those who are dissatisfied are likely to make changes.

Clients Satisfied with the Search Process Overall, Less So with Specific Components

When respondents were asked to rate their satisfaction with the agency search process they gave themselves high ratings – three-quarters were very or completely satisfied.

But, as with overall satisfaction, when respondents were asked to evaluate specific components of the search process, many acknowledged that neither the time allocated for the search nor the number of agencies identified in the selection process were sufficient.

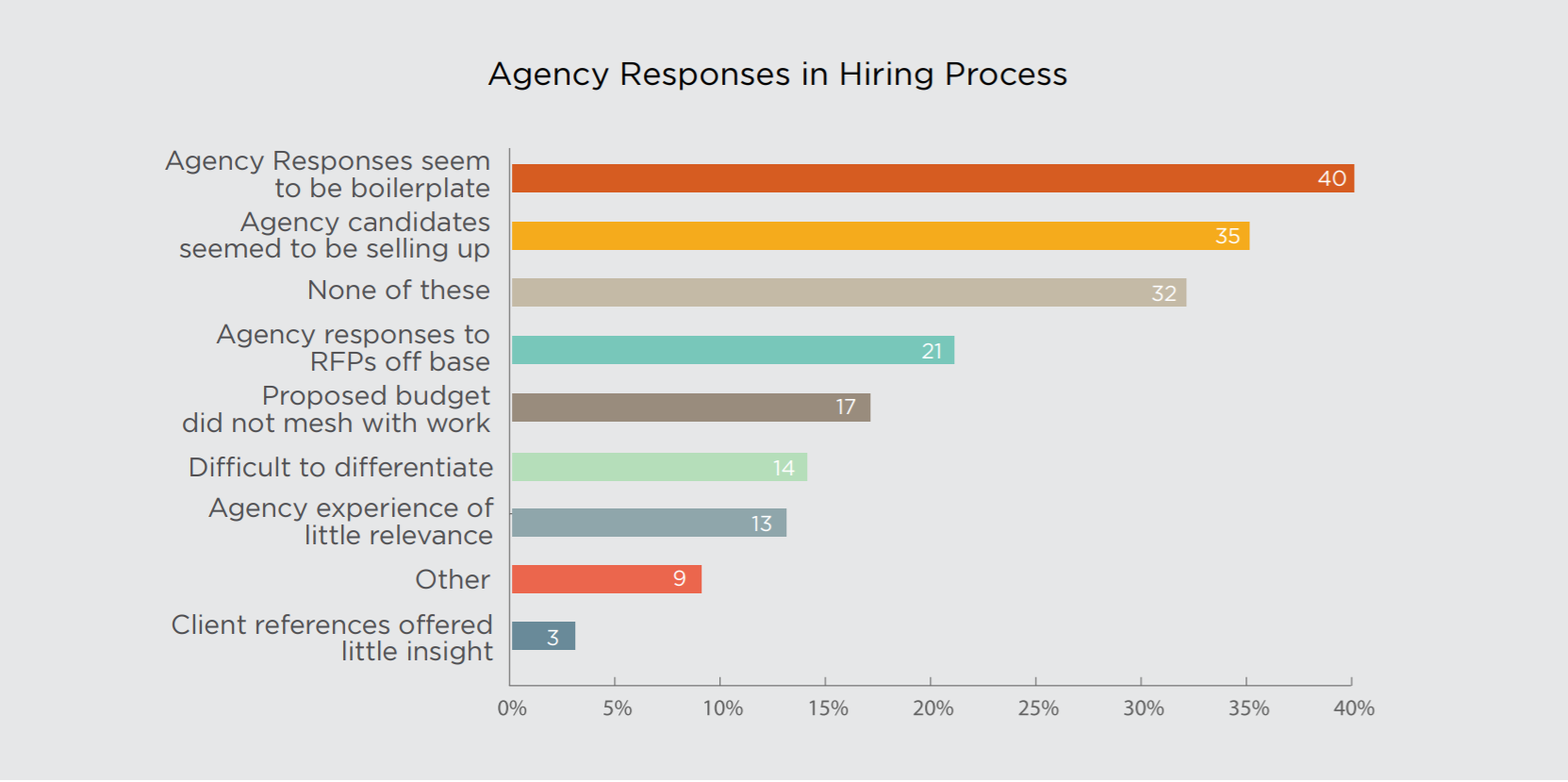

Significant numbers of respondents reported shortcomings on the part of agencies in their responses to RFPs, noting that agency proposals and presentations are often seen as boilerplate, agencies seem to be “upselling” during the process, and agencies fall short on their response to the scope of work and program goals, budgets, and staffing requirements.

Significant numbers of respondents reported shortcomings on the part of agencies in their responses to RFPs, noting that agency proposals and presentations are often seen as boilerplate, agencies seem to be “upselling” during the process, and agencies fall short on their response to the scope of work and program goals, budgets, and staffing requirements.

Qualitative Interviews

Interviewees identified agencies in a variety of ways. Typically this included relying on their staff and their professional peers outside their organization for recommendations:

Analysis

- As was the case with client satisfaction with agency performance, most respondents indicated they were satisfied overall with the process they used to search for, evaluate and ultimately hire their primary agency. But more than one-third expressed some degree of uncertainty in their selection process and the chosen agency. Respondents’ self-criticism seems to suggest a desire to implement a better process and clearer parameters in agency search and hiring.

- The recognition that including more agency candidates in the search process and taking more time would be better, highlights a gap between existing search processes and “best practices”. Drawing upon personal experience and anecdotal evidence, it’s clear that time and capacity are a significant constraint for communications leaders that result in a less than ideal search processes.

- Best practices include conducting a comprehensive search to identify qualified agencies and the allocation of internal resources or use of external agency search consultants as well as tools to support a thorough process to shortlist and select agencies.

Communications/Marketing Background vs. Satisfaction

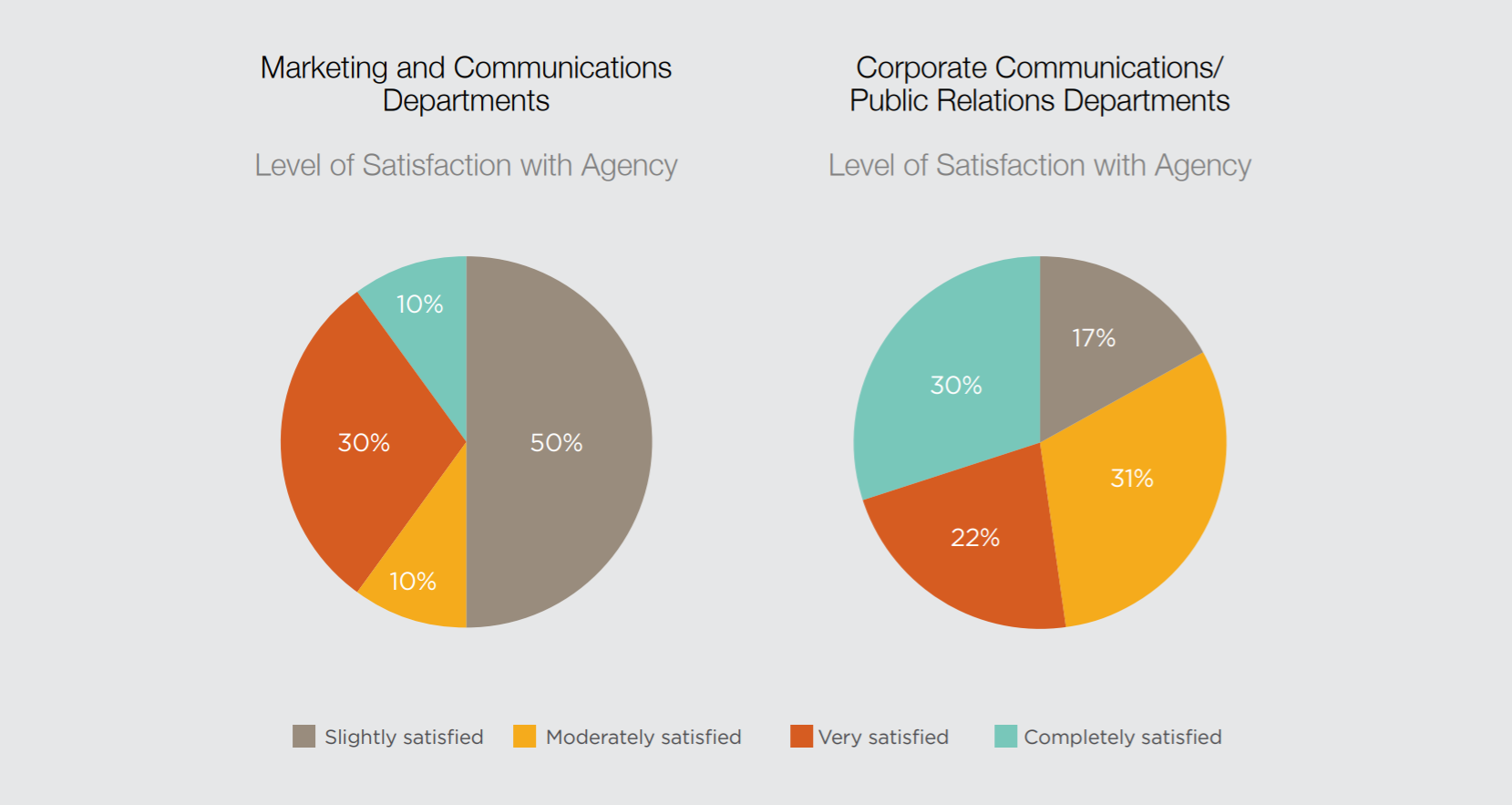

A point worth noting, because it stood out strongly across a range of questions, was the significant difference in responses when we looked at the data by department name, e.g. “corporate communications/public relations” (and related names) versus “marketing and communications” departments. There were also clear differences between those who had worked for PR agencies versus those who had not. Leaders of “marketing and communications” departments reported being less satisfied with their agencies, and tend to change agencies more frequently, than their corporate communications counterparts.

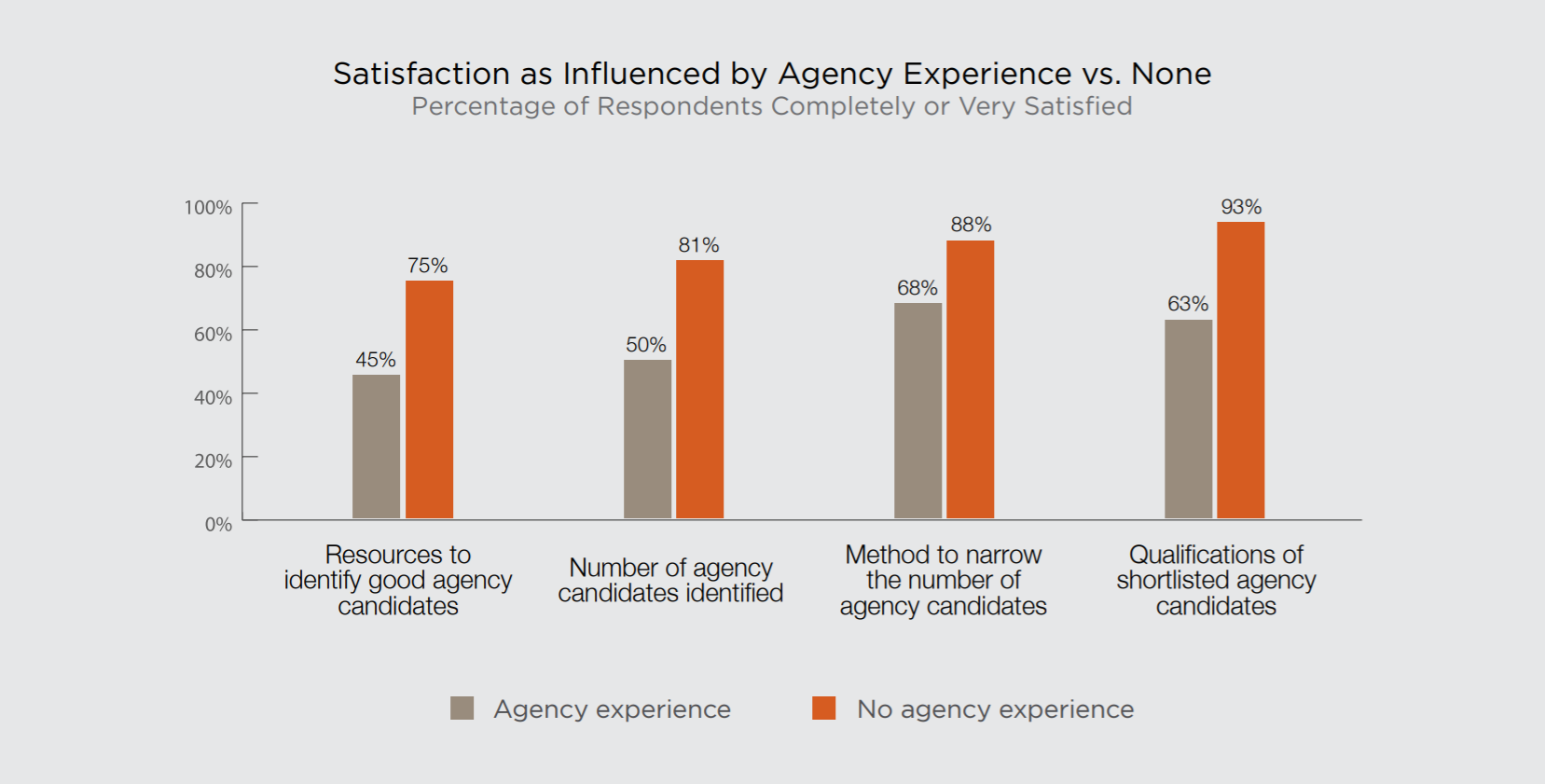

In terms of satisfaction with the agency search and selection process, communications executives with prior public relations agency experience consistently indicated lower satisfaction than their peers without agency backgrounds on such measures as available resources to identify agency candidates, the number of agency candidates identified, the method to shortlist candidates, and the qualifications of shortlisted agency candidates.

Analysis

- The background of communicators, whether marketing or PR, clearly makes a difference in how agencies are evaluated and their perceived success.

- The expertise and experience of communicators impacts the agency search process, expectations and potential longevity of the relationships.

- While we would not want to take this too far, the data suggests that leaders coming from a marketing background or who have a broader scope than a corporate communications department are less satisfied with agencies and more likely to change them.

- Communications executives with PR agency experience tend to be more demanding of agencies and of themselves when it comes to selecting agencies.

Comprehensive RFP Process Results in Better Outcomes

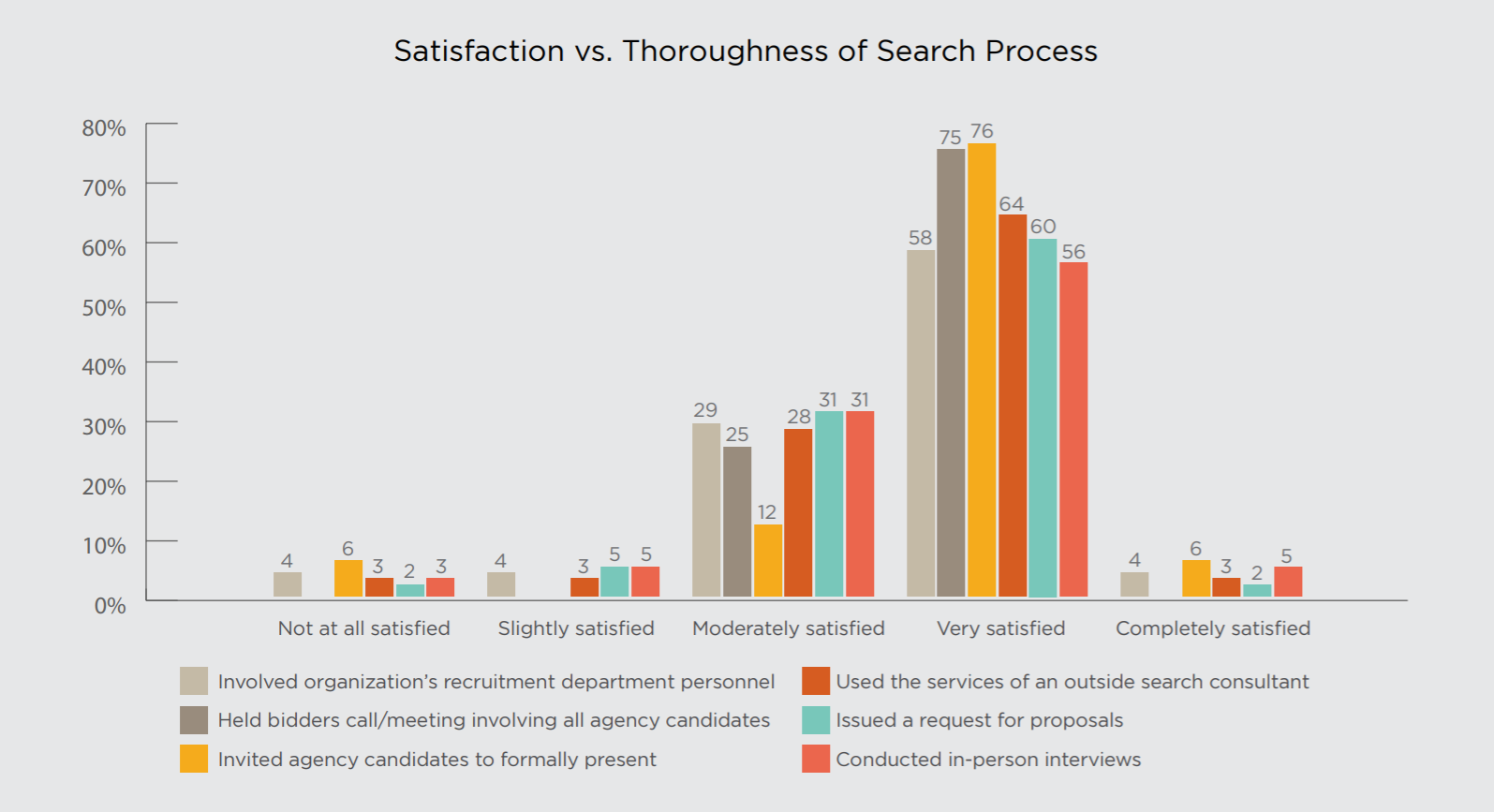

The research indicated that the more thorough the search process and the more a communications executive employs what can be considered agency search “best practices,” the greater likelihood of satisfaction with the agency selected.

Significant majorities of communications executives indicated they were “very satisfied” or “completely satisfied” with the selected agency when they held a bidders call/meeting with all candidates, conducted in-person interviews with agency candidates, and utilized a formal RFP process. That two-thirds of those surveyed used an RFP as part of the hiring process, underscores its value and efficiency as a tool to evaluate and shortlist agencies. And while it’s assumed that agencies would rather win business without an RFP, it is clearly seen as important by respondents.

In our conversations with agency leaders we consistently heard that many of the RFPs they receive are poorly structured or often don’t include key information agencies need to determine whether they are a good fit for an assignment or to fully understand what’s expected of them. The research bears this out. While goals and objectives and a scope of work was incorporated by 8 out of 10 respondents, only a little more than half of companies provided budget information or selection criteria.

IIn terms of agency responses to RFPs, many communications executives were most critical of perceived “boilerplate responses” as well as the feeling that agencies were “selling up” during the RFP process.

Qualitative Interviews

Analysis

- While most communications executives said they use a request-for-proposal process to guide their agency hiring decisions, a significant number omit key information in the RFP, including agency budget, selection criteria and/or timeline, and sensitive or confidential information (which we believe would be critical for agency candidates proposing strategies or approaches).

- Agencies typically do not like responding to RFPs, so if an RFP prompts more questions than it answers, and/or is lacking in detail or background, the client issuing the RFP is likely to receive less-than-stellar responses. For agencies, a poorly managed or overly complex RFP process does not motivate the type of custom responses companies seek.

- A streamlined RFP process, one endorsed by the industry, with the data needed by agencies to make decisions would clearly be beneficial.

- The research highlights a number of ways a more thorough agency search and hiring process is likely to lead to greater agency satisfaction and, ultimately, to greater agency longevity.

Conclusions

In this research we set out to show the impact of the agency search and hiring process on satisfaction with public relations agency performance and public relations programs and outcomes. From the research, a number of takeaways highlight the importance and wisdom of a thorough search process:

• Two-thirds of companies responding to the survey used an RFP process to select agencies

• When an RFP was used agencies were more likely to meet or exceed initial client expectations

• Although satisfied with their search process, many respondents noted that having more candidates and taking more time for an agency search was ideal

• Where procurement was involved in agency search, satisfaction with the selected agency was higher

• Higher satisfaction correlates with agency longevity

• The research also highlights gaps between the “ideal” search process and how searches are actually being conducted

• Communications executives surveyed overwhelmingly rely on industry knowledge, experience, and word-of-mouth to select agency candidates

• Executives typically identified only two to five candidates at the outset of an agency search

• RFPs issued by organizations do not consistently include all the information required by agencies to respond most effectively

• Respondents indicated a limited use of search consultants/tools in contrast to employee recruiting

The results also demonstrate why this matters:

- Despite strong overall satisfaction with agencies, around 40% of the time agencies are seen to be falling short in key areas important to clients

- Communications executives clearly wish that agencies would do a better job when responding to RFPs

- There is high agency turnover, even among the highest-paid agencies

The research data reinforces our experience, as former heads of communications, agency executives and now agency search consultants, that a thorough search process is likely to lead to better outcomes – namely, the retention of a better-suited agency which exceeds a client’s expectations. At the same time, the data underline the cost of getting the process wrong or giving it short shrift.

The results of this research should encourage communications leaders to follow their instincts to dedicate more time and implement a more comprehensive search process. Where time and capacity are an issue, the tools and resources we offer help companies conduct a thorough, objective search for qualified agencies, request capability information from those agencies, issue RFPs with the information agencies need, and manage the agency evaluation, selection, engagement and onboarding process.

Read our Recommendations for Communications Executives

Read our Recommendations for Agencies

LIST: Join 6,000 Agencies, Consultants & Freelancers on CommunicationsMatch

CommunicationsMatch is attracting thousands of visitors a month and the number of agency, consultant and freelancer searches is growing. It takes a few minutes to list your areas of expertise, bios, capabilities presentations, video, and post articles to our Insights Blog to drive SEO and new business leads. When you LIST you'll have unlimited search access. Click here to find out more.